A recurring topic in conversations with young entrepreneurs and journalists across India has been that of startup valuations. Despite all the writing that’s out there, innumerable forums and meet ups, some questions – often very basic ones – persist. The questions themselves vary in actual phrasing from

How do VCs or angels value startups?

How much should I raise?

How much should I dilute?

And each time as I’ve attempted to answer the questions raised, I’ve found us going back to the basics of What does valuation entail – what are its components and the math behind it.

Note: In India, when people talk of valuation, they are usually talking of post-money valuation and the dilution refers to the percentage the investor owns, after their money is invested.

At the risk of oversimplification, all fund raising and valuation – regardless of fundraising round (angel, seed, Series A) – breaks down to three variables, which from the entrepreneurs’ perspective looks like:

I believe my company is worth so much today (pre-money) pV

I intend to raise so much money- A

You sir investor will now own D% of my company

The reality though is more like this

Amount (how much money you absolutely need to raise?) A

Dilution (% you’re prepared to give & investor’s ready to accept for A) D%

Valuation (what the company’s worth post the investment (post-money)) V

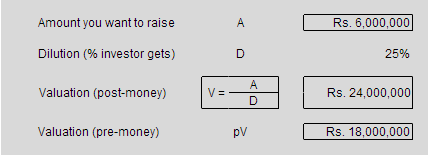

Math dictates that the post-money valuation is ![]()

(for the curious, pre-money valuation is obviously pV = V-A)

In this scenario, the valuation (V) is an artifact of how much money you absolutely need to raise (A) and how much ownership (D) you are prepared to give up (or how little the investor is prepared to accept). Once you fix any of these two variables the third is automatically fixed. So it’s important to understand which of the variables are really in your control and what degree of flexibility you have in them.

Amount So how much should you raise? Any kind of serious fund raising can easily take you six months between first discussion and the money hitting your bank. So it’s a good rule of thumb to raise money for 18 months of operation, so that you can focus on running your business for at least a year without having to worry about raising money. You’d need this money to cover the operational expense of running your business over the 18 months and any capital expense or investment that you’d make in the business. For a startup that’s not raised any outside (of friends & family) money, based on your business plan this amount may vary from as little as Rs. 45-50 lakhs ($65K) to say 1.5-2 Crores ($250K). So this fixes one variable (A) in the valuation triangle. Of course if you plan to start an airline (Indigo) or overnight delivery (FedEx) or semiconductor firm, you’ll need a lot more money to start with, but most of us can start with $60-100K.

Dilution Particularly for any first round (seed or angels) the investor likely would expect to get 20-25% of the equity. Depending on where your business is at – concept, prototype, early customer traction, they may go as low as 15% or want as high as 30%. This is largely a matter of the maturity or stage of your business, the perceived de-risking done and the line of business you are in.

Comparables (what other companies in your line of business, in your geography got valued at) are relevant as is your revenue, margins, free cash flow but treat them as rough guidelines rather than definitive stakes in the ground. Sure, your market size and share, your business plan, your product or service state all matters – but usually, in the Indian context valuation is not absolute but a direct output of answering the two questions.

- How much money do I need to raise in this round?

- How much ownership am I prepared to dilute

So for instance, if you seek to raise Rs. 60 Lakhs (Rs 6 million) and desire to dilute no more than 25%, then your post-money valuation is

Just as easily for the same money, if you have dilute more – your valuation could change without any real material change in your business. Depends how desperate you are and how greedy or generous the investor is. The table below shows the effect of A and D on valuations.

Reality rarely is this clean. Happy hunting.

Thank you for the post

Pradeep, Happy that you found post useful. As my friend @shirish sathaye commented elsewhere, raise enough for the next major milestone – the trick is of course figuring out what that is.

Understood. That’s what I’m doing – raising enough for the next milestone – 18 months from now. #godspeed #literally.

Thank you for the post

Pradeep, Happy that you found post useful. As my friend @shirish sathaye commented elsewhere, raise enough for the next major milestone – the trick is of course figuring out what that is.

Understood. That’s what I’m doing – raising enough for the next milestone – 18 months from now. #godspeed #literally.